what items are exempt from sales tax in tennessee

Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of. Some goods are exempt from sales tax under Tennessee law.

Tennessee Ag Sales Tax Tennessee Farm Bureau

Clothing school supplies computers food food ingredients and gun safety devices are items that fall under Tennessees three sales tax holidays.

. In most states necessities such as groceries. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Groceries is subject to special sales tax rates under Tennessee law.

What Items Are Exempt From Sales Tax In Tennessee. From July 29-31 clothing school supplies and computers with a few exceptions will be sales tax free according to the Tennessee Revenue Office. 67-6-228 state and local sales tax rates.

If you sell any. Groceries is subject to special sales tax rates under Tennessee law. By Eduardo Peters August 15 2022 August 15 2022.

Tennessee does not exempt any types of purchase from the state sales tax. Exemptions Certificates and Credits Agricultural Exemption. Heres a look at exempt and.

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along. What Canadian Businesses Need To. Groceries is subject to special sales tax rates under tennessee law.

Tennessee does not exempt any types of purchase from the state sales tax. For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax. The umbrella that protects an exempt entity from paying taxes.

All state and local. Some exemptions are based on the product purchased. The exceptions are available for.

Industrial Machinery including Accessories and Attachments Repair Parts. Tennessee Department of Revenue Taxes Sales Tax Holiday Follow STH-2 - Sales Tax Holiday - Qualifying Items During the holiday the following items are exempt from sales. Exempt Industrial Machinery Per Tennessee Sales Tax Exemption for Manufacturing.

At a total sales tax rate of 9250 the total cost is 38238 3238 sales tax. An exempt organization pays business tax on tangible personal property it sells if gross sales exceed 3000. 12 - Tennessee Sales Tax Exemptions.

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and. Several examples of of items that exempt from Tennessee. In Tennessee certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

How Are Groceries Candy And Soda Taxed In Your State

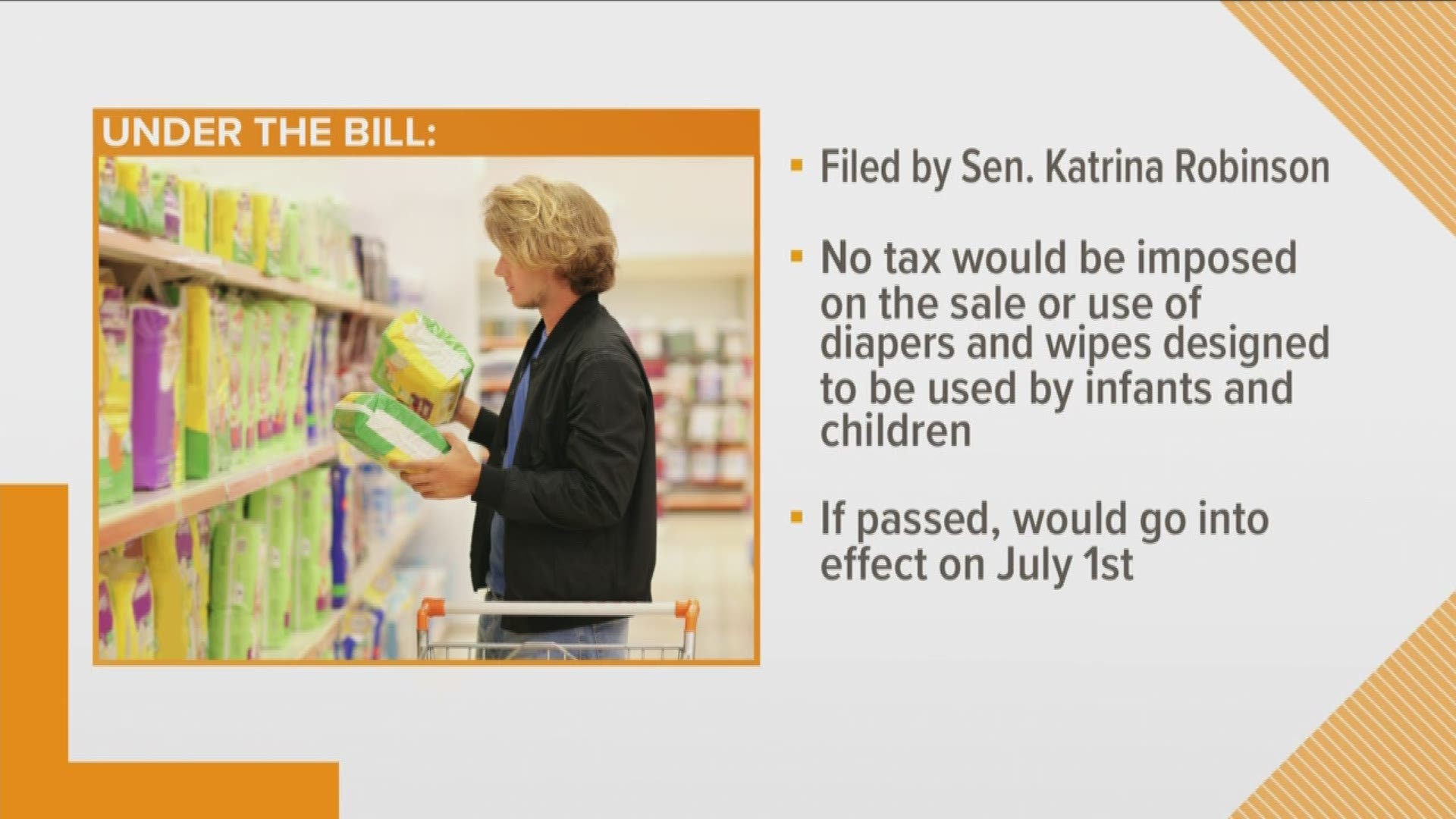

Tennessee Senator Wants Diapers Wipes To Be Exempt From Sales Tax Wbir Com

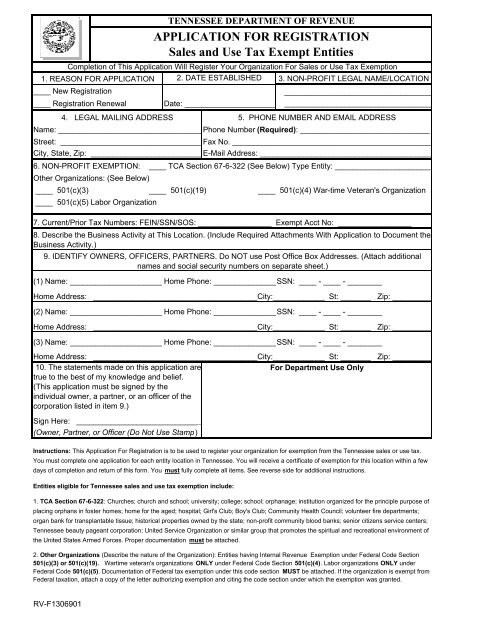

Form F1308401 Application For Registration Agricultural Sales And Use Tax Certificate Of Exemption Fill In

Historical Tennessee Tax Policy Information Ballotpedia

How To Use A Tennessee Resale Certificate Taxjar

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Three Sales Tax Holidays Coming Soon In Tennessee

Tennessee Sales Use Tax Guide Avalara

How To File And Pay Sales Tax In Tennessee Taxvalet

How To File And Pay Sales Tax In Tennessee Taxvalet

Tennessee Sales Tax Handbook 2022

Tennessee Sales Tax Holiday What You Need To Know

Tennessee Non Profit Sales Tax Exemption Certificate

Using The Tennessee Sales Tax Resale Certificate Youtube

3 Sales Tax Holidays In Tennessee Wreg Com

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tn Sales Tax Holiday This Weekend Another For Groceries In August Local News Local3news Com

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today